SKC

-

CCorporation

A leading company that strive for the world’s best.

A leading company that strive for the world’s best.

-

CCreation

Global ESG material solutions company

Global ESG material solutions company

-

CCommunication

SKC is making efforts to create a better future for all of our partners.

SKC is making efforts to create a better future for all of our partners.

-

CCareer

SKC is making efforts to create a better future for all of our partners.

SKC is making efforts to create a better future for all of our partners.

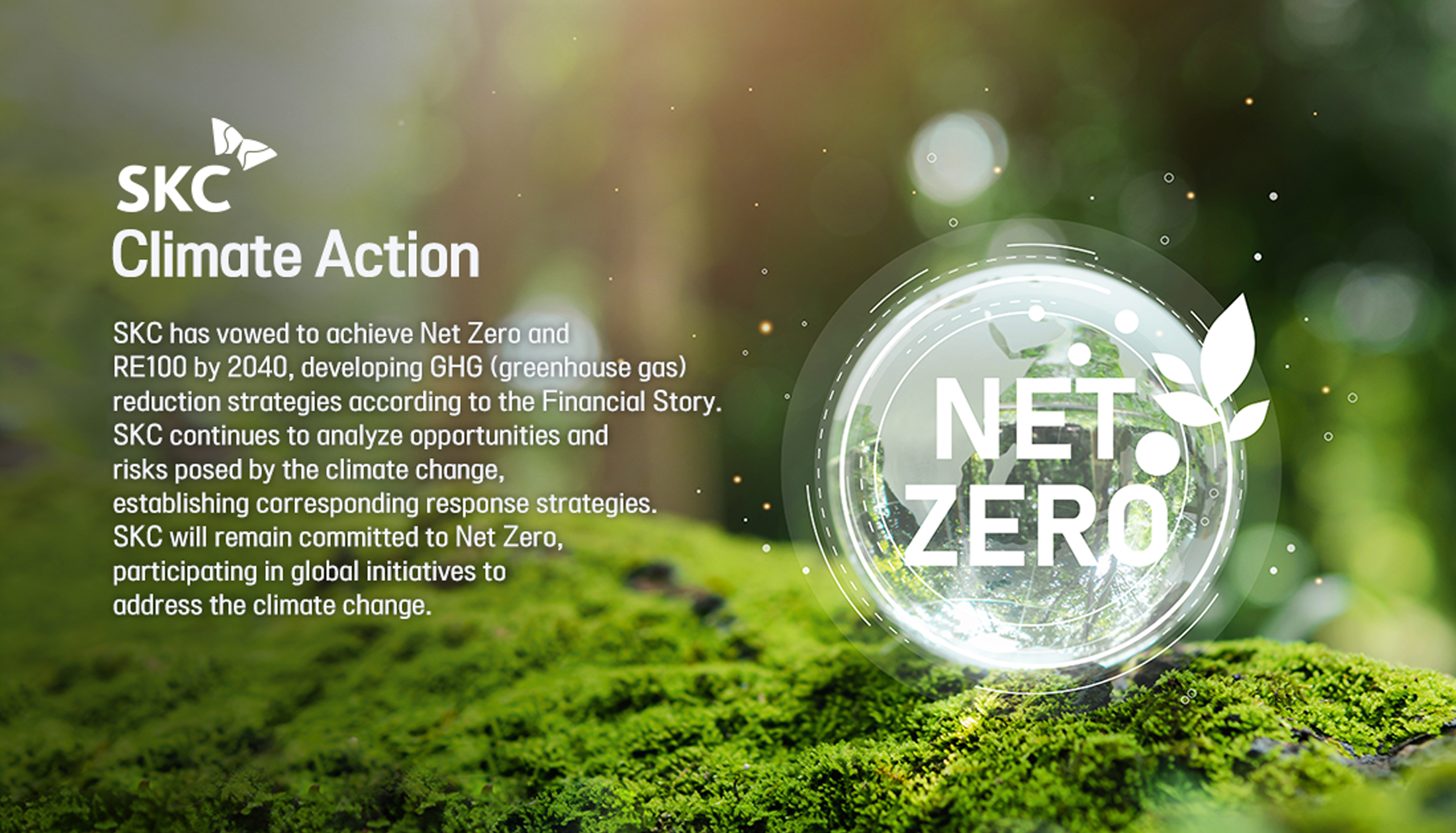

Climate Action

2040 GHG Net Zero

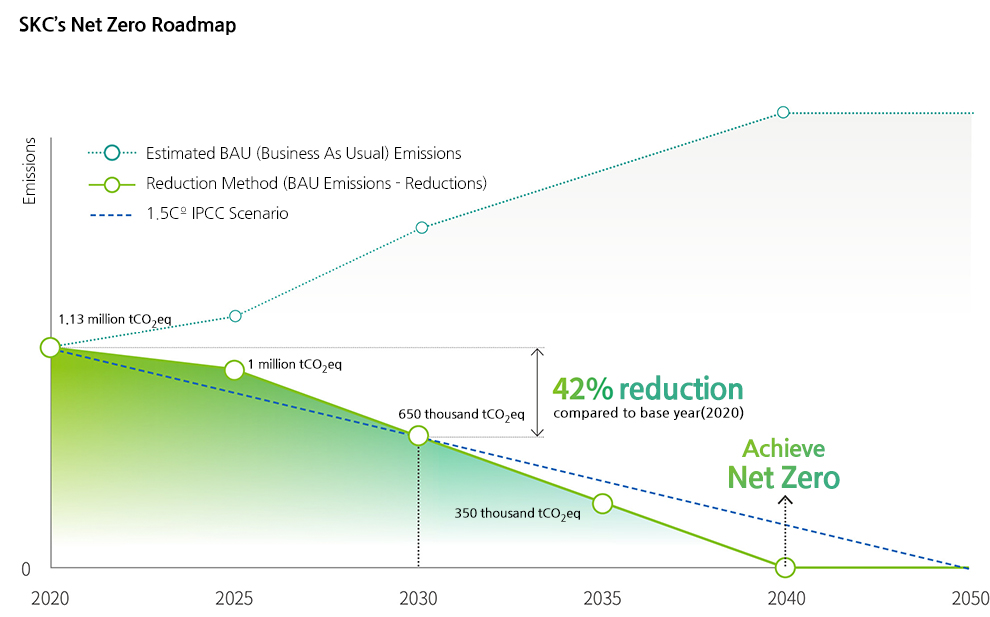

2040 Net Zero RoadmapSKC’s ultimate Net Zero goal is to reduce net emission to ‘0’ by 2040. The goal has been identified in consideration of the 1.5℃ scenario of the IPCC (Intergovernmental Panel on Climate Change) and the SBTi standards. Furthermore, to make the ultimate goal more reachable and feasible, an interim target has been established to reduce net emission by 42% of the base year (2020) emission of 1.13 million tCO2eq by 2030.

-

Net Zero

GHG Emission Reduction

2030 42% reduction (vs 2020)

2040 Achieve Net Zero

-

Renewable Energy

Share of Renewable Energy

2030 65%

2040 100%

The most important strategic instrument in SKC’s Net Zero implementation strategy is to achieve RE100 (Renewable Electricity 100%). SKC expects electricity consumption (Scope 2) to account for about 85% of its GHG emission as of 2030 and desires to reduce it by sourcing renewable energy. When adding production capacity/building new plants overseas in Malaysia, Poland, etc., SKC plans to achieve RE100 when such plants go live. Furthermore, SKC will reduce Scope 1 emission by improving process efficiency in the short run and work on energy transition from fossil fuel to electricity in the mid to long run, considering the maturity of available technologies.

Scope 3 Emission ControlExpanding the scope of Net Zero to supply chain, SKC has disclosed and controlled Scope 3 emission data verified by a 3rd party since 2023. Scope 3 covers greenhouse gases emitted indirectly not only in production of products but also the entire product lifecycle from raw material purchase to product use and scraping, rendering it difficult for SKC to reduce it single-handedly. Accordingly, SKC has selected critical control points out of 15 categories defined in Scope 3 in line with the characteristics of respective businesses, planning to develop a phase-wise reduction strategy in cooperation with key upstream and downstream stakeholders.

Climate related Risk Management

Transition Risks

The international community is ramping up GHG regulations to stop the earth temperature from rising. SKC, having a variety of stakeholders at home and abroad, analyzes the risks posed by regulations on climate change exacerbated by greenhouse gases and endeavors to launch preemptive responses. For one thing, SKC, subject to the emission credit trading system in Korea, has analyzed the financial impacts of such regulations derived from climate change scenarios. Concerning the 4th planning period (2026 to 2030) for which details are yet to be published, SKC has based analysis on the NDC scenario and the NGFS1) carbon pricing scenario, etc. If SKC emits greenhouse gases without any reduction initiative in Korea, about KRW 250 billion of cost is estimated to be incurred by 2030. To minimize such risks, SKC considers adopting the carbon pricing system. Financial risks of carbon regulations will be factored in investment process, and GHG emission regulation risks will be addressed by direct reduction and expanding renewable energy proportion, according to the Net Zero roadmap. Furthermore, SKC anticipates that the EU CBAM recently introduced or plastic tax, etc. will emerge as mid to long-term transitions risks. As the applicable scope of the EU CBAM may have varying impacts on SKC products, SKC is closely monitoring and reviewing corresponding regulatory trends.

1) NGFS: Network for Greening the Financial System

SKC has analyzed the physical risks that the climate change may have on each manufacturing site. SKC analyzed the IPCC SSP-RCP2) scenarios using S&P Global’s Climanomics® hazard model. Global climate risks for assets covered in the analysis were predicted and Impacts of eight climate risks3) were assessed by a quantitative economics model as the ratio of estimated loss4) to the present asset value.

2) SSP: Shared Socioeconomic Pathway, RCP: Representative Concentration Pathway

3) Abnormal temperature, drought, water shortage, coastal inundation, river flooding, typhoon, torrential rain

4) MAAL: Modeled Average Annual Loss

-

SSP5-8.5 (Scenario in which mankind still depends on fossil fuel power generation, with sluggish progress in GHG emission reduction policy enforcement, resulting in the earth temperature rise of 4.4℃ by 2100)

-

High

- Asset loss ratio attributable to extreme temperature was analyzed to be the highest. Enterprise-wide asset loss ratio by ’50 is estimated to reach 1.91%, which may vary, subject to SKC’s business portfolio expansion.

- Asset loss ratio attributable to extreme temperature was found to be the highest in the business sites in China at 4.93%. Corresponding figure for the business sites in the United States and Europe was about 2%, and relatively lower at around 1% in the cases of Korea and Malaysia.

-

Mid

- Loss ratios from fluvial flooding and pluvial flooding were in the range of 0.2%, lower than extreme temperature in terms of criticality. Yet, fluvial flooding and pluvial flooding were still rated as the 2nd and the 3rd-most critical risks.

- Enterprise-wide loss ratio related to fluvial flooding was 0.27%, with the SKC business site in China and SK pucore business site in the United States analyzed to be subject to 0.43% and 0.3% respectively, which seemed relatively higher. Business sites elsewhere were distributed in a relatively low range of 0.1%.

- Loss ratio from pluvial flooding was 0.24% enterprise-wide, with the Malaysian business site rated to be the highest at the same figure as the enterprise-wide loss ratio. Next came SK pucore’s U.S. business site and SK nexilis Poland site which showed relatively higher ratios of 0.22% and 0.16% respectively. Loss ratios of other business sites were found to be in the range of less than 0.1%.

-

Low

- All loss ratios from drought, wild fire and tropical cyclone were found to be less than 0.1%, featuring low risk levels. Loss ratio from water stress and coastal flooding was analyzed to be 0% by ’50.

- SK nexilis Malaysian business sites and SK pucore Indian business sites were analyzed to be subject to the lowest physical risks from the climate change, and the total loss ratio from the eight extreme climate events was analyzed to be less than 1%.

In the IPCC SSP5-8.5 scenario, the physical risks seem to be maintained at the aforementioned trends on a longer time horizon beyond 2050.

SKC will analyze short/mid/long-term physical risks annually and develop a system of control and response addressing more relevant risk factors.